"Give me a bazooka so I don’t have to use it"; shy away from social judgments embedded in credit allocation; small biz need fiscal support, not more borrowing; inflation won't stay up...

Read MoreSoros's wisdom on "reflexivity" and boom/bust cycles. Any sign of Fed policy change could cause a dramatic downturn in markets. Rising inflation could be 2021's biggest Black Swan...

Read MoreThe ill-advised and failed attempts to attach simple, reductive causality and narrative to complex problems fuels polarization and distorts academic studies...

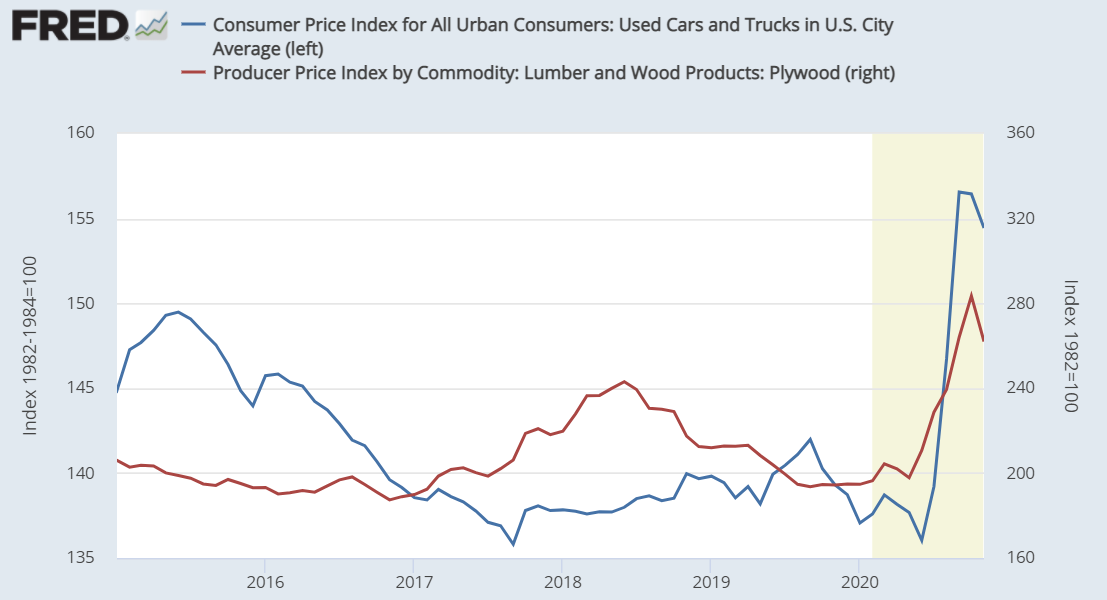

Inflation is determined by a basket of goods & services. Covid caused no signs of broad-based inflation. If you are worried about it, you have to point out where exactly it’s coming from.../What could cause high inflation in 2021? Too much demand met by too little supply; surging commodity prices; supply chain constraints; dollar depreciation; money printing; average inflation targeting./What could keep inflation low in 2021? Slow vaccine distribution; high unemployment; weak consumer spending; zombie companies muting real economic growth; too much government debt...

Read MoreTrump's black swan triggered exactly what his supporters feared, and our backlash against the Capitol violence and Trump will likely further spur what we hope to suppress…

Guess where the Covid data in Hawaii was first released every day back in March? The Instagram story of the Lt. Gov of Hawaii. Yep – that’s how insane all this is...

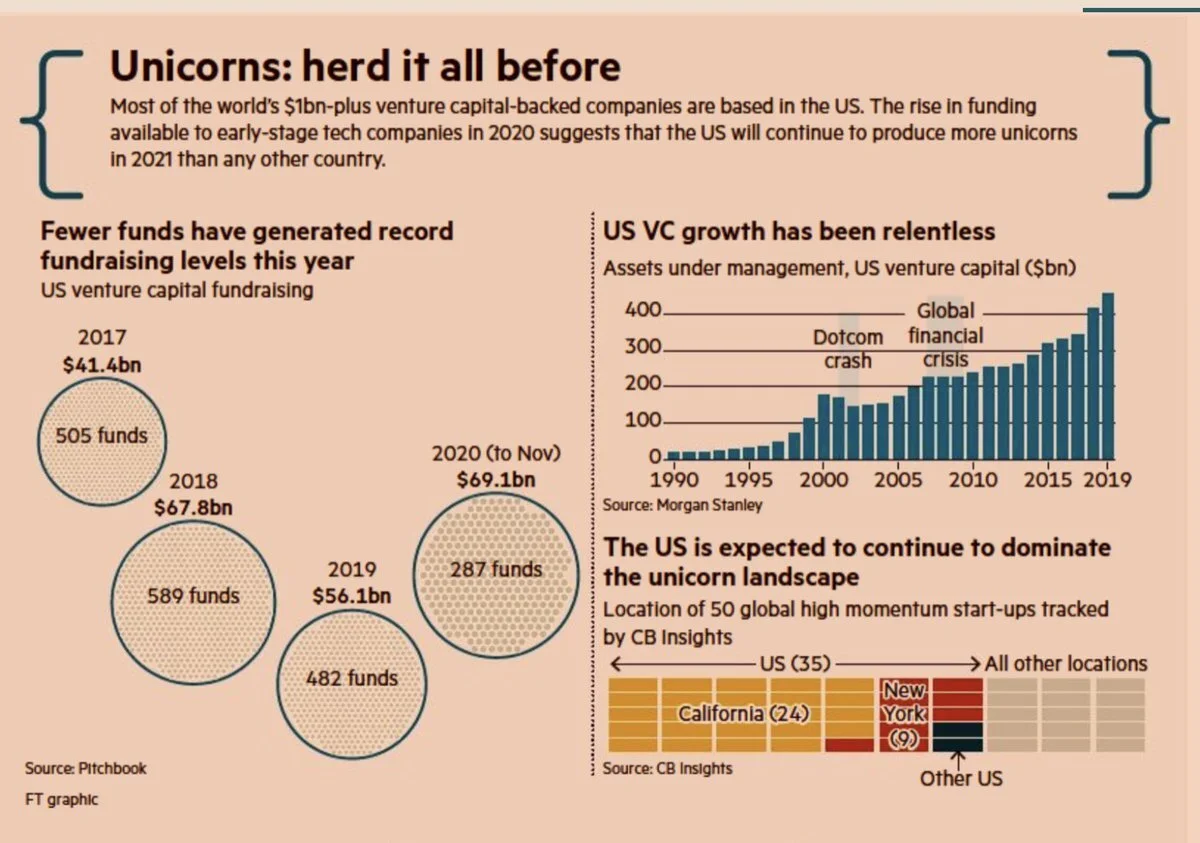

What role should the gov and free market play to spur innovations? Is the society allowing VC funds to waste money on meaningless "tech innovations" that should've been dedicated to public good?...

Finance has become a magnet for the brightest graduates in STEM, and a recent research shows that this has grave consequences – such as a 6.6% cumulative loss in labor productivity growth...

Nassim Taleb and Adam Tooze say it's not; I disagree. Just cuz' a few experts issued a warning, doesn't mean the disaster was predictable or preventable. Trying to predict uncertainties is inherently futile and unhelpful; plus the experts didn't correctly predict much in the first place...

The road to hell is paved with good intentions...

Read MoreI think we’re possibly in something much bigger than the 2000 dot com bubble...

Read MoreThe Fed had their well-anticipated December FOMC meeting this past Wednesday. They will maintain the current pace of QE (quantitative easing) until achieving "substantial further progress" towards their dual mandate goals (higher inflation and lower unemployment). The announcement plays well into our recent email theme of market exuberance. Will Carpenter and I wrote the following note for your digest.

Read MoreMaking Chinese EV companies big pandemic winners...

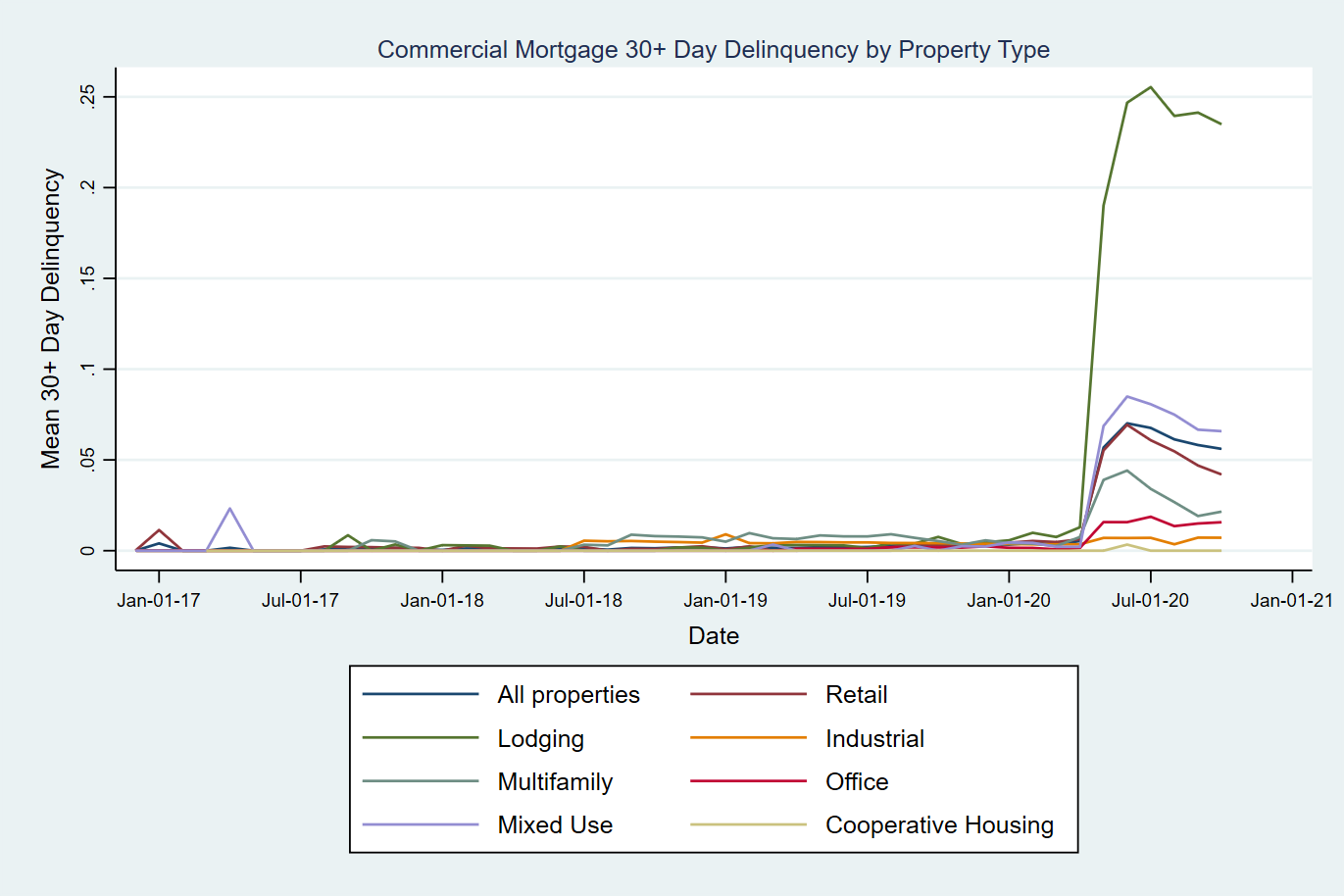

Read MoreAsset-backed securities in Covid…

Read MoreStatistical inference in the Covid era...

Read MoreA much wiser economist uttered a crucial idea a few months ago that essentially predicted today’s situation: If Biden wins but the Republicans still control the Senate, it would be easy for Biden to push for establishment Democrats for political appointments…

Read MoreWhen the coronavirus hit the United States, I was amid the delirium of my senior year at Princeton University. Just around the corner awaited the end of classes, the submission of my senior thesis, graduation exercises, and the nostalgic celebration of a very important four years.

Read MoreGripped in the throes of the coronavirus pandemic, our world has been upended as we have faced an enormous loss of life, prolonged social isolation, rampant racial tensions, and economic despair. Unlike several other countries, however, the United States has continued to struggle to contain, trace, and treat the novel coronavirus. At the time of writing this essay, the United States has been besieged by nearly 7 million confirmed cases and 200,000 deaths—an incalculable and bewildering loss. As a result, the pandemic has left many Americans distrustful of the government’s ability to safeguard public health, and rightly so.

Read MoreThese days the vibes in my gym have been very jolly because “STONKS are up HUGE” and all the guys are happily staring at their Robinhood accounts instead of getting ripped like me. S&P 500 jumped more than 7% last week – best week since April – amidst elections uncertainty, record case counts, and round 2 lockdowns in Europe. What is going on?! Torsten Slok, Chief Economist of private equity fund Apollo Global Management, did a webinar at Princeton recently. I asked Torsten this question during the Q&A session, and here are some of his reasons and my thinking. You may watch the recording of Torsten’s webinar on our YouTube channel here.

Read MoreLet me use this as an opportunity for my own reflection, and I hope it could spark some interesting discussions. I imagine many of you may push back fiercely, so as usual please don’t hold back.

Things we got right:

David Pakman and I said a few weeks ago that Biden’s chance is no more than 50-50, and that appears to be the case today.

WTF is going on with the polls? This past weekend we said Nate Silver is no better than Crackhead Jim; we iterated that view again at 8pm on election night; by midnight everyone had this thought in their mind. “We ran 40,000 simulations of the election forecast and Nate Silver was wrong in 90% of them.

More importantly, what we got wrong…

Read More