I wish to have gone to the Miami Bitcoin conference, but I lost all my savings investing in Bitcoin... Leaders in crypto are brilliant, but their dynamic with average Bitcoiners feels like a religion.

Traditional finance started with funding real-world projects. Decentralized Finance started with trading financial claims & optimizing self-referential speculation. But DeFi could still be the future?

Read MoreInterview w/ the king of financial newsletter. Bitcoin foregrounded the value of sheer social coordination, and you can do it as many times as you want. GameStop is the new Dogecoin!

Read MoreBiden gives $80 billion to passenger rail. We need $50b just to maintain the current level & $300b to build next-gen. It's inadequate but also the best we've ever got, so what's Biden's mandate?

Read MoreInflation has been off-the-charts for so long – nobody knows what's going on anymore. Just take whatever data you need to justify your politics, and whatever politics to justify your data...

Read MoreInterview w/ Tony Yoseloff of Davidson Kempner on distressed investing in Covid, market froth, Robinhood, etc. "The market is a very powerful force itself... What is speculative remains to be seen."

Read MoreWhy couldn't Bridgewater generate alpha? Is it cuz' the average employee no longer believes in Ray Dalio's Principles? David reflects on being fired from Co-CEO, Covid performance, founder transition.

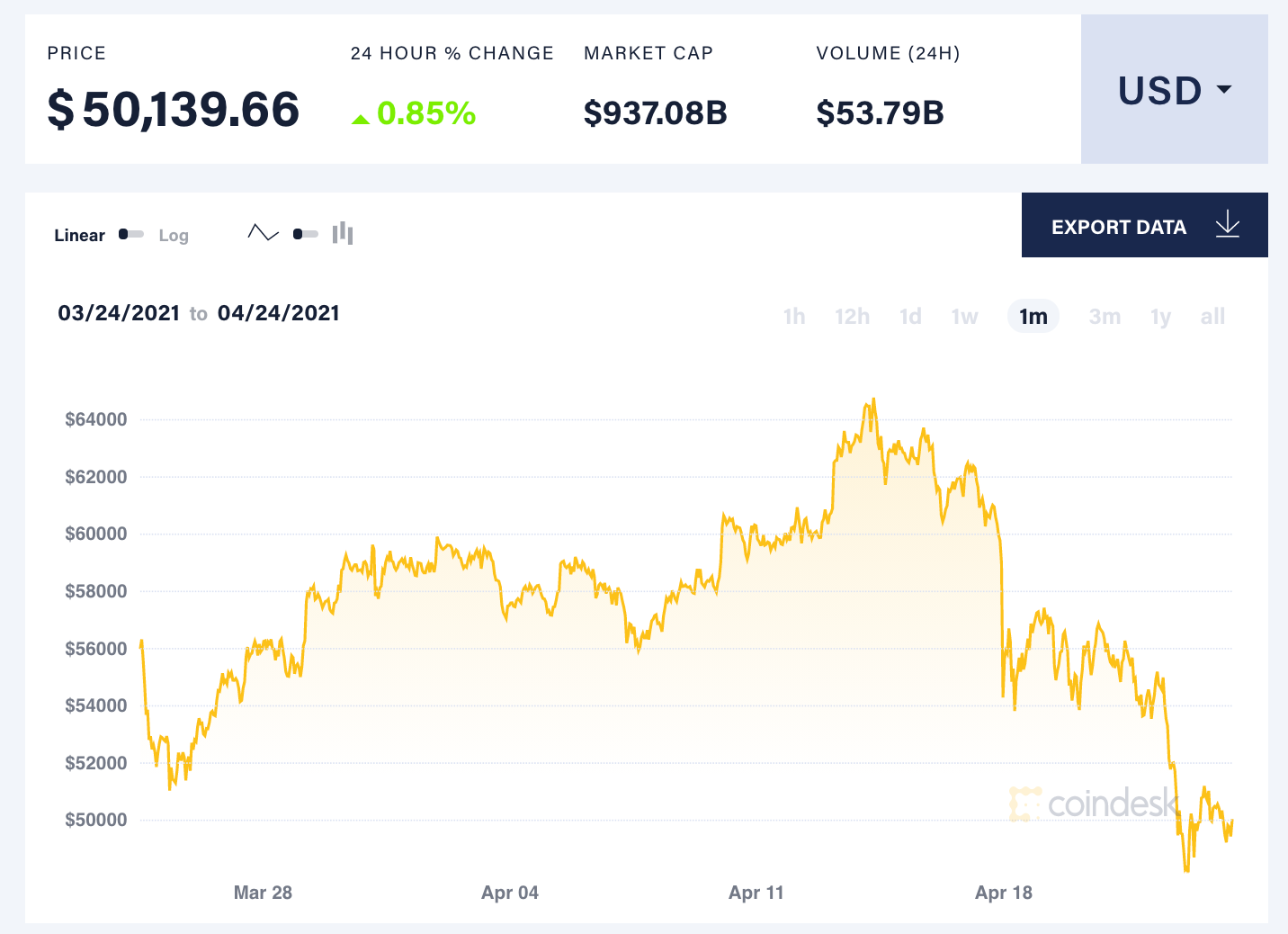

Read MoreWe’re now in the age of excess when it comes to the media & investors talking about Bitcoin all day long cuz' they can't generate alpha elsewhere. With emotions running high, is another crash coming?

Read MoreInterview w/ Ben Hunt from Epsilon Theory. The power of the crowd watching the crowd as social control, its Nth-order impact on market dynamics, and Wall Street nudging us to play its game...

Read MoreMany frauds in the NFT space and it's likely a bubble. But NFTs aren't just JPEG files; there are real innovations behind. In the digital age, NFTs represent an unstoppable secular trend...

Read MoreA million traders liquidated 10 billion dollars to cause 20% crash. It was a classic leverage & liquidity-driven market accident. People with price targets are just trying to sell you products...

Read MoreWe now have a reactive, not preemptive Fed. They won't act based on forecasts, so if I believe inflation is coming, I should have every reason to trust my own forecast and not the Fed's script...

Read MoreA deep dive on how minting & selling NFT actually works. Join the creator economy revolution, get rid of centralized gatekeepers, and build the digital "metaverse" future with us...

Read MoreInfrastructure bill will pass through reconciliation w/o R-votes. Dems consider their slim majority as mandate to reshape America, not prioritizing progressive policy push over keeping majority...

Read MoreDigital currency is not that dope and actually kind of creepy. Stop saying that China’s digital currency is threatening the US; only America's own digital currency can threaten the US...

Read MoreI'm not fully in Larry Summer's camp... Fiscal stimulus might not work that magically; inflation is a slow process; plenty downside risks to recovery; secular forces will push inflation down...

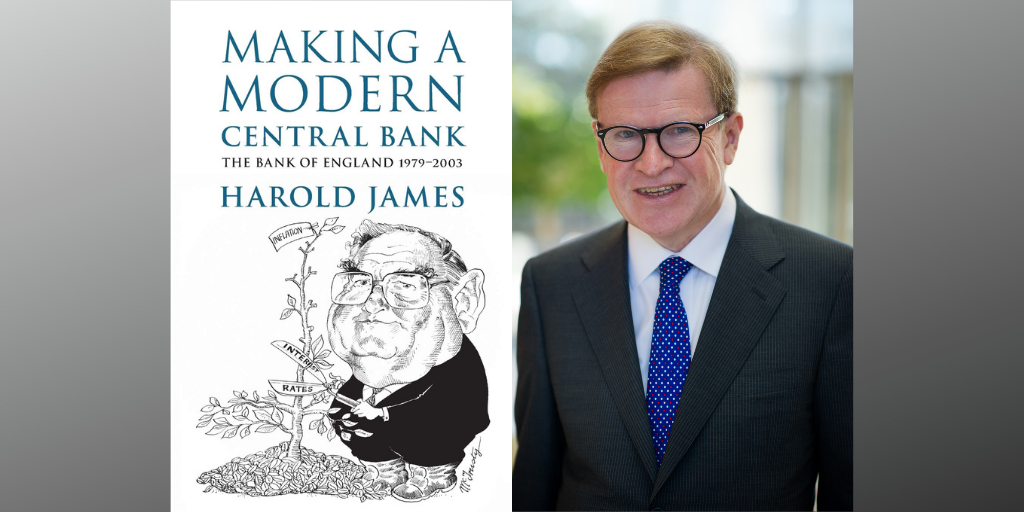

Read MoreSure, inflation in 2020 may indeed be transitory, but we should plot out a clear exit strategy so that inflation expectations don't become unanchored. Interview w/ financial historian Harold James...

Read MoreIt may be foolish to say everything follows some deterministic equilibrium like "markets only go up," but you must have a hypothesis about when & what is going to change that brings the market down...

Read More2nd half of my interview with INET President Rob Johnson. The smaller the stakes, the bigger the fight. Do Nobel Laureates have ZERO policy impact? Are truths attainable? When will this bubble burst?

Read MoreMy question to Goldman Sachs Chief Economist Jan Hatzius on likelihood & magnitude of downside risks. Will the system collapse in 2021? It's a problem that buying stocks feels like buying Bitcoin...

Read More